- The Tims® Credit Card is a Mastercard® with no annual fee1 and designed to offer quicker ways to earn Tims Rewards Points to redeem for more free coffee, beverages and food at Tim Hortons.

- Tims® Financial is a new division of Tim Hortons, committed to giving Canadians convenient and powerful financial tools to manage their everyday finances.

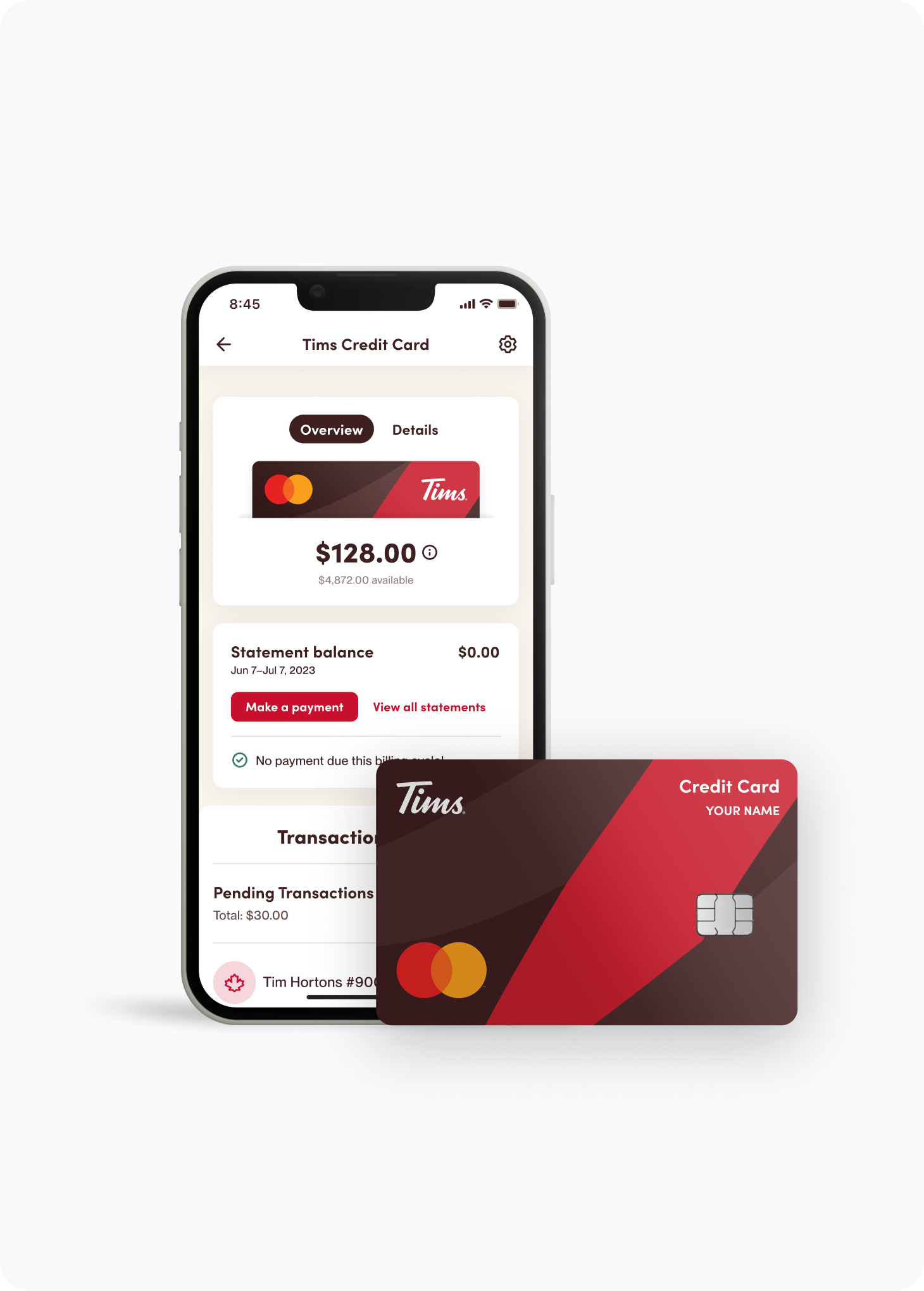

- Full integration with the Tim Hortons app makes it easy to apply for the Tims Credit Card, get approved and check your balance – all from your phone.

- Earn Tims Rewards Points everywhere you shop2, plus up to 5 points per dollar on most gas, groceries and transit purchases, and up to 15 points3 per dollar on eligible purchases at Tim Hortons restaurants when you scan for Tims Rewards.

- Students, newcomers, and others with limited or no credit history will be offered a version of the Tims Credit Card that will earn Tims Rewards Points and may help build their credit4.

Tim Hortons is proud to introduce the new Tims Credit Card from Tims Financial, a division of the company established to give Canadians convenient and powerful financial tools to manage their everyday finances.

The Tims Credit Card is a Mastercard®, powered by Neo Financial™. It has no annual fee1 and earns Tims Rewards Points everywhere you shop2, with up to 5 points per dollar on most gas, groceries and transit purchases, and up to 15 points per dollar when you use the card on eligible purchases at a Tim Hortons restaurant and scan for Tims Rewards. This means faster access to more free coffee, beverages and food at Tim Hortons restaurants.

"With almost five million Canadians actively using our Tim Hortons app every month, it became obvious that we could offer our most loyal guests a way to earn Tims Rewards Points even faster with everyday spending and higher points on most gas, grocery and transit purchases5," said Markus Sturm, Senior Vice President of Digital, Loyalty and Consumer Goods at Tim Hortons.

The Tims Credit Card can be applied for, approved and managed entirely through the Tim Hortons app on your phone.

There will also be a version of the Tims Credit Card offered to Canadian residents who have limited or no credit history – like students and newcomers – that will earn Tims Rewards Points and can help build their credit4.

"We have designed the most attractive credit card for Canadians that love Tim Hortons and want the opportunity to earn even more free coffee, beverages and food. We believe this is an exciting new financial option for millions of Canadians, including newcomers and students who are looking to build their credit history," added Sturm.

Sign up for the waitlist at timsfinancial.ca and be one of the first to know when the Tims Credit Card becomes available in the coming months.

_____________________________ |

The Tims® Credit Card, powered by Neo Financial™, is issued by ATB Financial pursuant to license by Mastercard International Incorporated. |

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. |

1 The Purchase Credit Rate on the Tims® Credit Card is 20.99%-25.99% and the Cash Advance Rate is 22.99%-27.99%. For Quebec: Monthly Statements; No monthly or annual fees; 21-day grace period; Minimum payment is the higher of $10.00 or 5.0% of total statement balance; Purchase rate 20.99%-24.99% and cash advance rate 22.99%-25.99%. The standard rate on Purchases and Cash Advances is dependent on our assessment of your credit application, credit profile, and your province. See your Cardholder Disclosure at time of application for your specific rate. |

2 Certain purchases are prohibited by law from earning Tims® Rewards Points. |

3 At participating restaurants in Canada. Terms and conditions apply. Visit the Tims app or www.timhortons.ca/timsrewards or www.timsfinancial.ca for full details. |

4 When you make payments in full and on time each month. |

5 Costco and Walmart are excluded from gas and grocery points. |

ABOUT TIM HORTONS

In 1964, the first Tim Hortons® restaurant in Hamilton, Ontario opened its doors and Canadians have been ordering Tim Hortons iconic Original Blend coffee, Double-Double™ coffees, Donuts and Timbits® in the years since. Over the last 55 years, Tim Hortons has captured the hearts and taste buds of Canadians and has become synonymous with serving Canada's favourite coffee. Tim Hortons is Canada's largest restaurant chain operating in the quick service industry with nearly 4,000 restaurants across the country. More than a coffee and bake shop, Tim Hortons is part of the Canadian fabric and guests can enjoy hot and cold specialty beverages – including lattes, cappuccinos and espressos, teas and our famous Iced Capps® – alongside delicious breakfast, sandwiches, wraps, soups and more. Tim Hortons has more than 5,400 restaurants in Canada, the United States and around the world. For more information on Tim Hortons visit TimHortons.ca.

ABOUT NEO FINANCIAL

Neo Financial is a technology company simplifying finances through reimagined spending, savings, investing, and mortgages. Founded in 2019 by the co-founders of SkipTheDishes, Neo has raised more than $299 million in funding from top-tier investors and has been recognized as one of the top tech startups in Canada by LinkedIn. Neo is headquartered in Winnipeg and Calgary, and is backed by top investors across North America. Neo for Business powers financial solutions for Intuit TurboTax®, Hudson's Bay, and over 10,000 other partners across the country. To learn more, visit neofinancial.com.

ABOUT ATB FINANCIAL

With $58.5 billion in assets, ATB Financial is an Alberta-built financial institution that is a catalyst for economic growth in our province. We got started in 1938 to help Albertans through tough economic times. Today, ATB Financial's more than 5,000 team members love to deliver exceptional experiences to nearly 800,000 clients through our many branches and agencies, our 24-hour Client Care Centre, four entrepreneur centres, and our digital banking options. ATB powers possibility for our clients, Alberta and beyond.